Mortgage borrowing ratio

Ultimately your maximum mortgage eligibility. How the borrowing power calculator works.

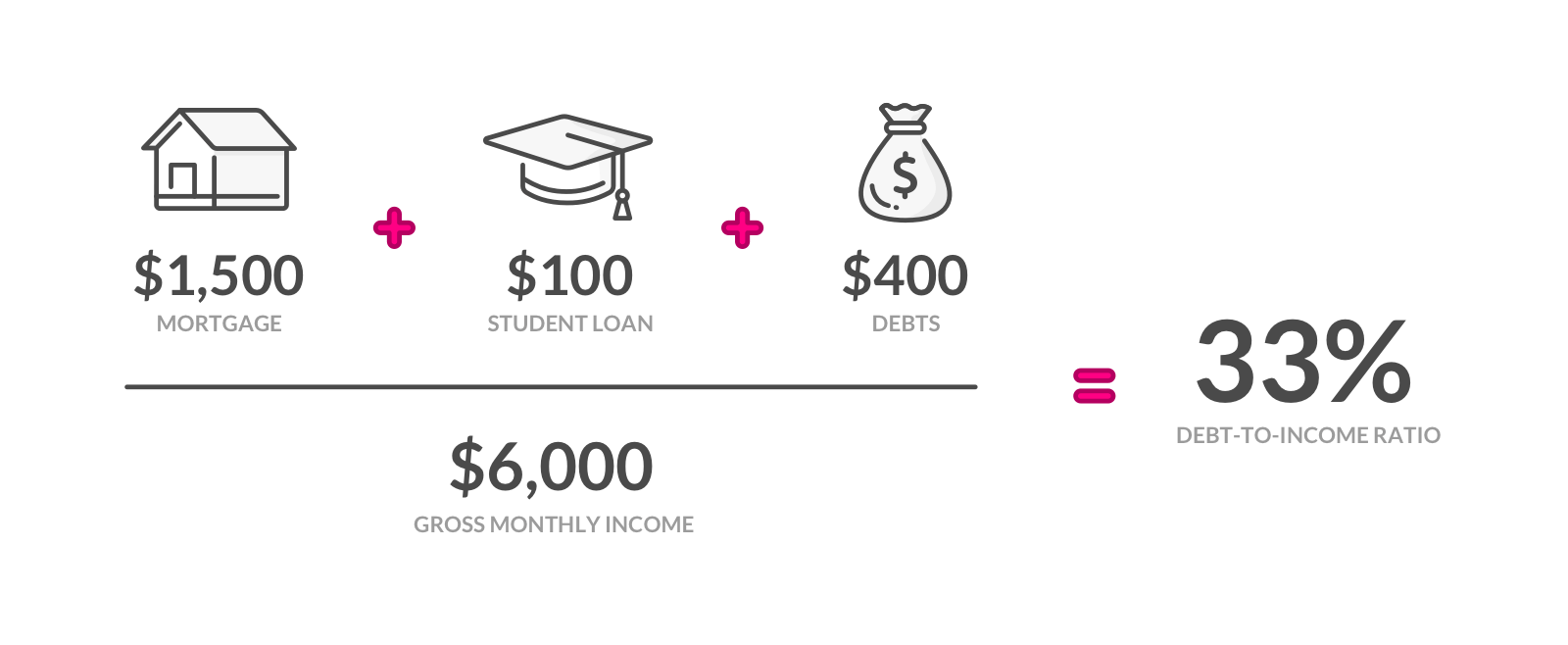

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Reached about 6 per cent per annum.

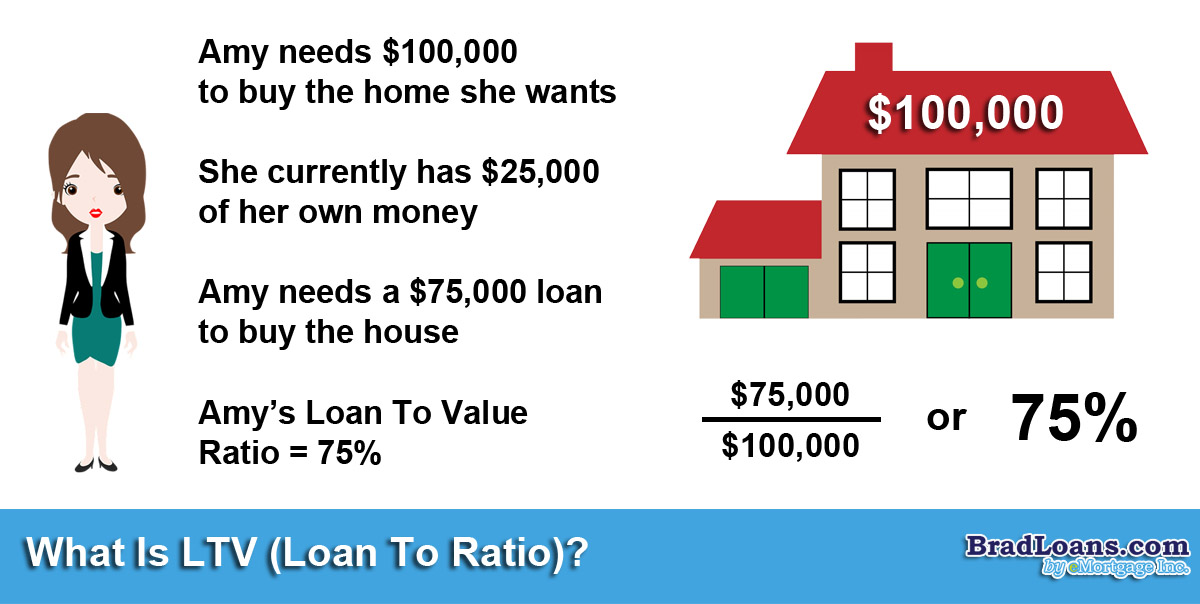

. Mortgage lenders will consider your loan-to-value ratio LTV the amount youre borrowing compared to the overall cost of the loan. What More Could You Need. If you choose to make a larger down payment and only borrow 240000 your mortgages LTV will be.

Apply Now With Rocket Mortgage. See Todays Rate Get The Best Rate In A 90 Day Period. A DTI of 43 is typically the highest ratio a borrower can have and still get qualified for a mortgage but lenders generally seek ratios of no more than 36.

The LTV of that loan is. Loan-to-value ratio for mortgage. Lenders generally also look for a debt-to-income ratio of 36 for mortgage.

Loan-to-value LTV ratio. If your current loan balance is 100000 and your home appraises for 200000 the equation would be. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

The debt-to-income ratio in mortgage loans is the same measure used in personal loan products. 240000 300000. The borrowing amount is a.

Sample 1 Based on 3 documents Remove Advertising Examples of Borrowing. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home. This ratio compares the amount you hope to borrow with how much the property is worth.

Ad FHA VA Conventional HARP And Jumbo Mortgages Available. The lower the loan to value ratio the less risk you pose to the lender. Typically the higher your deposit the lower your LTV.

614K minus the 50K down. Borrowing Ratio means the quotient of 1 divided by 175 multiplied by 100 and expressed as a percentage. Ad NerdWallet Reviewed Mortgage Lenders To Help You Find The Right One For You.

For homebuyers who are trying to qualify for an FHA loan an acceptable. The more you put toward a down payment the lower your LTV. Mortgage loans backed by the Federal Housing Authority FHA come with a different set of rules.

To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. Typically a loan-to-value ratio should be 80 or less to avoid having to add PMI.

270000 300000 90. Ad Compare Mortgage Options Calculate Payments. Assuming relatively low debts 300 per month and a 30 mortgage rate this person might be able to borrow up to 564000 for a mortgage.

How To Calculate Debt To Income Ratio

Debt To Income Ratio Formula Calculator Excel Template

How To Calculate Your Loan To Value Ratio Finder Com

Loan To Value Ratio Ltv Formula And Example Calculation

How To Calculate Your Debt To Income Ratio Lendingtree

:max_bytes(150000):strip_icc()/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Qualifying Ratios Definition

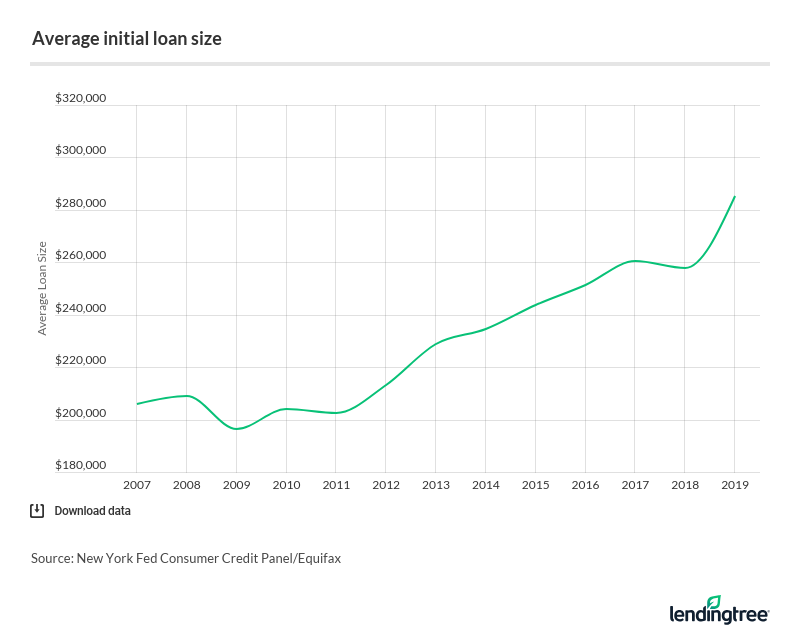

U S Mortgage Market Statistics 2020

/dotdash_INV_final_Qualifying_Ratios_Jan_2021-01-33089daf17f749d8b71dfec13e9415cf.jpg)

Qualifying Ratios Definition

Mortgage How Much Can You Borrow Wells Fargo

Debt To Income Dti Ratio What S Good And How To Calculate It

Loan To Value Ratio Prepnuggets

Fha Requirements Debt Guidelines

Debt To Income Ratio Dti Limits For 2014 Fha Conventional And Qm

4 Steps Every Homebuyer Should Follow When Getting A Mortgage Morty Blog

What Is The Debt To Income Ratio Learn More Citizens Bank

Mortgage Ratios It S Not As Difficult As You Think Achroma

What Is Ltv Loan To Value Ratio Brad Loans By Emortgage